Japan's Edge in the

Global Market

24 - 27 February 2026 | Tokyo, Japan

-

5600+ Attendees

- |

-

74 Countries

- |

-

132 Partners

- |

-

26% Female Speakers

- |

-

70% C-Suite and Decision Makers

- |

-

47% International Attendees

- |

-

330+ Speakers

- |

-

491 FinTechs

- |

-

79 Investors

- |

-

14% in Central Banks, Regulatory Institutions & Government Organisations

- |

-

5600+ Attendees

- |

-

74 Countries

- |

-

132 Partners

- |

-

26% Female Speakers

- |

-

70% C-Suite and Decision Makers

- |

-

47% International Attendees

- |

-

330+ Speakers

- |

-

491 FinTechs

- |

-

79 Investors

- |

-

14% in Central Banks, Regulatory Institutions & Government Organisations

- |

Forum Highlights

Join us at the GFTN Forum, Japan where the rich heritage of Japan intertwines with cutting-edge financial technology. As part of the renowned Japan FinTech Week, the GFTN Forum, Japan 2025 will gather over 200 global speakers to explore the transformative role of Japan in the global financial landscape. With a dynamic agenda featuring deep dives, keynote sessions, and strategic roundtables, attendees will gain invaluable insights and practical tools and strategies to thrive in the fintech sector. Don't miss this unique opportunity to connect with industry leaders, share ideas, and be part of a vibrant community shaping the future of fintech!

Japan FinTech Week

2026 Featured Speakers

-

Candace Kelly

Chief Legal & Policy Officer

Stellar Development Foundation

Candace Kelly

Chief Legal & Policy Officer

Candace Kelly is the Chief Legal & Policy Officer for the Stellar Development Foundation (SDF), a non-profit organization that supports the development and growth of Stellar, an open-source network that connects the world's financial infrastructure. She leads the team responsible for SDF’s legal affairs and the policy team that is focused on bridging the gap between the public and private sectors.

Previously, Candace worked for Uber Technologies, Inc., where she helped navigate the company’s response to regulatory investigations and advised on safety, security, privacy, consumer protection, and law enforcement response. Prior to that she served for 17 years at the United States Department of Justice as a federal prosecutor and as counsel to the Attorney General, the Deputy Attorney General, and the Director of the Federal Bureau of Investigation. -

Chan Yam Ki

Vice President, Asia Pacific

Circle

Chan Yam Ki

Vice President, Asia Pacific

Yam Ki Chan is the Vice President for Asia Pacific of Circle (NYSE: CRCL), responsible for the company’s business and strategy in the region. He leads a team responsible for partnerships and market expansion across the region. Yam Ki advises stakeholders on how stablecoins unlock economic opportunities for businesses and economies. Yam Ki also serves as the Managing Director of Circle Singapore. He oversaw the enablement of USDC in Japan, the first stablecoin recognized in the country.

Prior to Circle, Yam Ki held strategy & operations and public policy roles at Google Payments and Google Cloud, where he worked on partnership strategy, market launches, and government affairs.

Before Google, Yam Ki served as a Director at the White House National Security Council, where he coordinated U.S. economic strategy in Asia and was a member of the U.S. negotiations team for the G-20 and G-7. Before joining the National Security Council staff, Yam Ki worked in the U.S. Department of the Treasury’s Office of the U.S.-China Strategic and Economic Dialogue and the Committee on Foreign Investment in the United States. Earlier in his career, Yam Ki worked in technology investment banking at Jefferies in Silicon Valley.

He earned a Master of International Affairs from Columbia University and a Bachelor’s degree in Economics from Carleton College. -

Fernando Vázquez

President of Capital Markets

Chainlink

Fernando Vázquez

President of Capital Markets

Fernando is the President, Capital Markets, of Chainlink. Fernando started his journey in academia, where he first became deeply involved with the budding Linux community in the early 90s. This led him to the corporate world with a number of roles at the NTT Group starting in 2003, where he contributed to the mainstreaming of open source. He transitioned into the FinTech world, joining Japanese financial conglomerate SBI in 2016 where he held several roles including CEO of SBI Digital Asset Holdings, a pioneer in digital capital markets and founding member of Project Guardian. He also serves on the boards of regulated financial institutions and foundations globally and is a member of the Monetary Authority of Singapore's International Technology Advisory Panel.

-

Fiona Murray

Vice President & Managing Director, APAC

Ripple

Fiona Murray

Vice President & Managing Director, APAC

Based in Singapore, Fiona Murray is Vice President and Managing Director of APAC for Ripple, leading the company’s strategy and business operations in the Asia Pacific region.

During her tenure she has played an instrumental role in onboarding key partners and products critical to digital asset trade across the region, including building out payment rails for on/off ramping and overseeing the growth of OTC in APAC. She drives Ripple's efforts to scale enterprise blockchain and crypto adoption in this region's fast-growing digital asset hubs, including working to secure the company's landmark Major Payments Institution (MPI) license from the Monetary Authority of Singapore (MAS).

Fiona joined Ripple in 2018 and has led the APAC sales team since 2020. Prior to Ripple, Fiona held business development positions within large enterprises, including Oracle, Fiserv and Misys (now Finastra), helping financial institutions innovate in payments across Europe and Asia.

Fiona holds a Master of Arts in Politics, Philosophy and Economics from the University of Oxford. In her spare time, she enjoys chasing her toddler around Singapore and indulging in the occasional round of Muay Thai boxing. -

Inderbir Singh Dhingra

Chief Investment Officer, IFC AMC & Head, Global Infrastructure Fund & Principal, Emerging Asia Fund

International Finance Corporation (IFC)

Inderbir Singh Dhingra

Chief Investment Officer, IFC AMC & Head, Global Infrastructure Fund & Principal, Emerging Asia Fund

Inderbir is part of the leadership team at the IFC AMC, IFC’s private equity business managing third-party capital. He joined the IFC AMC as a Key Person in raising and investing IFC’s Emerging Asia Fund and is also leading the Digital Transformation Fund. He has additional responsibility as Head of the IFC Global Infrastructure Fund. Inderbir focuses on investing across emerging markets in Asia and serves on the Boards of several portfolio companies in technology, financial services and fintech, renewables, pharmaceuticals and special situations. He has more than 25 years of experience in private equity and mezzanine investments, equity research, and public policy. Prior to joining the IFC AMC, Inderbir held various positions in the Financial Institutions Group at IFC, including managing the South Asia portfolio and subsequently leading the direct equity investments across Asia Pacific. He has also worked at the World Bank on Infrastructure PPPs, Innovation Policy and Investment Climate. Prior to joining the World Bank Group, Inderbir served as a Vice President at Credit Suisse First Boston (CSFB) and Deutsche Bank, leading their Equities Research for the Pharmaceuticals, Telecom Services & Equipment, and Media sectors in India.

Inderbir holds an MBA equivalent from the Indian Institute of Management, Ahmedabad, a Bachelors in Commerce (Honors) from Shri Ram College of Commerce, Delhi University, and a Diploma in Business Finance from the Indian Chartered Financial Analyst Institute. -

Jawed Ashraf

Chairman, India Trade Promotion Organization; Former High Commissioner of India in Singapore & Ambassador to France & Monaco

Indian Foreign Service

Jawed Ashraf

Chairman, India Trade Promotion Organization; Former High Commissioner of India in Singapore & Ambassador to France & Monaco

Joined the Indian Foreign Service in 1991 and retired in December 2024. He now writes and comments on international affairs and strategic, defence and security issues. Has served in Indian Missions in Frankfurt, Berlin, Kathmandu and Washington DC and as High Commissioner of India to Singapore from 2016 to 2020 and as Ambassador of India to France and Monaco from 2020 to December 2024.

In New Delhi, he held various positions in the Americas Division, including as the Head of the Division, in the Ministry of External Affairs. He served as Joint Secretary (senior adviser) in the Prime Minister's Office with former Prime Minister Dr. Manmohan Singh and Prime Minister Narendra Modi, with the portfolio comprising foreign policy, defence,, national security council, atomic energy, space and, briefly, science and technology.

Studied Economics at undergraduate level from St. Stephen's College, Delhi, and Management at Master's level from Indian Institute of Management Ahmedabad. The French Government has decided to confer the Commander of the Legion of Honour for his contribution to the development of India-France relations. -

Jesper Koll

Global Ambassador

Monex Group, Inc.

Jesper Koll

Global Ambassador

Jesper Koll

Expert Director & Global Ambassador for the Monex Group and the Japan Catalyst Fund

Jesper Koll has been researching and investing in Japan since becoming a resident in 1986. Over the past two decades, Jesper has been consistently recognized as one of the top Japan strategists/economists, having worked as Chief Strategist and Head of Research for U.S. investment banks J.P. Morgan and Merrill Lynch. He currently serves as Expert Director for the Monex Group and the Japan Catalyst Fund (Japan’s 1st retail investor based corporate engagement/activist fund). His analysis and insights have earned him a position on several Japanese government and corporate advisory committees and he is an Ambassador for FinCity Tokyo. Jesper serves on the board of directors of OIST (Okinawa Institute of Science & Technology) and Asia Society (Japan). Jesper is an economist, angel-investor, patron; and yes, a Japan Optimist. -

Kenneth Gay

Chief FinTech Officer

Monetary Authority of Singapore

Kenneth Gay

Chief FinTech Officer

Kenneth heads the FinTech and Innovation Group at the Monetary Authority of Singapore (MAS). The Group is responsible for development strategies for technology and innovation, to strengthen competitiveness, manage risks and enhance the efficiency of the financial sector.

Kenneth’s recent prior experience focused on digital transformation, enterprise GenAI and data governance. He previously headed the Enterprise Knowledge Department at MAS. Besides formulating data and knowledge strategies and governance policies, the department also pursues data transformation by architecting and developing platforms and applications that improve outcomes for financial supervision, central banking and other use cases.

Kenneth also has experience in regulatory policy, having previously headed MAS’ Prudential Policy Department. The department develops capital and liquidity standards, including MAS’ approach on the implementation of Basel III as well as contributions to international policy forums. Prior to this, Kenneth headed the international financial relations and financial stability surveillance functions in MAS, and served in MAS’ reserves management and enforcement functions.

Kenneth holds a BA in Economics and MA in International Relations from the University of Chicago. He enjoys experimenting with technology at work, and as a pastime. -

Leong Sing Chiong

Deputy Managing Director, Markets & Development

Monetary Authority of Singapore

Leong Sing Chiong

Deputy Managing Director, Markets & Development

Mr Leong Sing Chiong was appointed as Deputy Managing Director for Markets and Development on 1 February 2021. He oversees the Markets & Investment, Development & International, FinTech & Innovation, as well as Sustainability Groups. Prior to this, Mr Leong served as Assistant Managing Director overseeing the Monetary & Domestic Markets Management Department and the Reserves Management Department since June 2018. He also served as Assistant Managing Director of the Development and International Group from 2013-2018.

Mr Leong began his MAS career with the Reserves Management Department in 1993 and served as Staff Assistant to the Managing Director from 1997-1998. In 1999, he joined the Monetary Management Division and was responsible for the implementation of MAS’ monetary policy and money market operations. Thereafter, Mr Leong was appointed Chief Representative of MAS’ London Representative Office from 2002-2004. Mr Leong spent six years with the International Department from 2004-2010 and was appointed as the Executive Director of Financial Centre Development Department from 2010-2013.

Mr Leong is a recipient of the Public Administration Medal (Silver). He holds a B.Sc Economics (Monetary Economics) from the London School of Economics and is married with two children. -

Makoto Shibata

Head of FINOLAB, Chief Community Officer

FINOLAB Inc.

Makoto Shibata

Head of FINOLAB, Chief Community Officer

Mr. Shibata is currently in charge of FINOLAB community operation since 2019. In his former position at The Bank of Tokyo-Mitsubishi UFJ, he was leading R&D initiatives in emerging technology and online/mobile financial services as Head of Global Innovation Team. He also held positions in corporate planning, accounting, corporate finance, and retail customer services at the bank. He is one of the founders of FINOVATORS, a mentor group consists of FinTech experts. He also became an external board member at new digital bank, UI Bank, when it acquired a banking license in 2021. For his undergraduate course, he studied Economics at the University of Tokyo, with a year at Harvard University. And for his graduate course, he studied at the University of Oxford to obtain Master of Science in Development Economics.

-

Masashi Namatame

Senior Managing Executive Officer & Group Chief Digital Officer

Tokio Marine Holdings, Inc.

Masashi Namatame

Senior Managing Executive Officer & Group Chief Digital Officer

Namatame joined Tokio Marine Holdings in 2018 and was appointed Managing Executive Officer and Group Chief Digital Officer in 2021, and promoted to Senior Managing Executive Officer in 2024. Prior to Tokio Marine, he was Managing Director, and the member of the board at BlackRock Japan. Before that he had a number of senior executive positions at Visa Worldwide Japan, Morgan Stanley and Deutsche Bank. He started his career at Long-Term Credit Bank of Japan. In addition to his career positions, he assumed the non-executive director at Mercari, Inc. and an advisor to Japan's Financial Services Agency. He graduated from University of Tokyo and earned MBA from Harvard Business School.

-

Neil Parekh

Deputy Chairman, Global Finance & Technology Network (GFTN) & Vice Chairman Asia Pacific

Sumitomo Mitsui Banking Corporation (SMBC)

Neil Parekh

Deputy Chairman, Global Finance & Technology Network (GFTN) & Vice Chairman Asia Pacific

Neil serves as the Group Deputy Chairman and Board Director at the Global Finance & Technology Network (GFTN). He is also Vice Chairman, Asia Pacific for Sumitomo Mitsui Banking Corporation (SMBC) Group. Until recently, he was Partner and Head of Asia and Australia at Tikehau Capital. He previously held the position of CEO, Asia at National Australia Bank.

Neil is a Council Member of the Singapore Business Federation and the Singapore Institute of Directors and serves as an Advisory Board Member of the James Cook University, Singapore, and the Singapore Fintech Association. He also serves as a Senior Adviser to the Atlantic Council in Washington DC. and is a Fellow of the Singapore Institute of Directors as well as the Australian Institute of Company Directors. He is also the Chairman of the Singapore Indian Chamber of Commerce and Industry.

He served as a Nominated Member of Parliament in Singapore from 2023 to 2025. He has also served on the Governing Council of the Association of Banks in Singapore and as Chief Executive Officer of Pegasus Asia, a company listed on the Singapore Stock Exchange. -

Nick Clark

Director of Technical Assistance, Financial Innovation for Impact (Fii) & Cambridge Centre for Alternative Finance (CCAF)

Cambridge Centre for Alternative Finance

Nick Clark

Director of Technical Assistance, Financial Innovation for Impact (Fii) & Cambridge Centre for Alternative Finance (CCAF)

Nick is the Head of the Cambridge Regulatory Innovation Hub at the Cambridge Centre for Alternative Finance. Nick leads research programmes with domestic and international regulatory and policy making bodies in both emerging and developed markets. Prior to joining the Centre, Nick worked at the Financial Conduct Authority in London for over a decade, latterly heading up the FCA’s regulatory sandbox.

-

Noritaka Okabe

Chief Executive Officer

JPYC

Noritaka Okabe

Chief Executive Officer

Noritaka Okabe began his entrepreneurial journey in 2001 while studying at Hitotsubashi University, founding his first company and serving as Representative Director and Director/CTO. In 2017, he co-founded Real World Games Inc., where he held key positions including Director/CTO and CFO before continuing as a Director. In 2019, Okabe established Japan Cryptoasset Market, Inc. (now JPYC Inc.) and became its Representative Director.

Since 2021, Okabe has led the issuance of the yen-denominated prepaid token “JPYC Prepaid.” That same year, he was appointed Visiting Professor at the Professional University of Information and Management for Innovation (iU) and Director of the Blockchain Collaborative Consortium (BCCC). In July 2023, he became Chair of the BCCC’s “Blockchain Adoption Promotion Committee,” and since June 2025, he has also served as a Director of the Japan Cryptoasset Business Association (JCBA). -

Philip Weiner

Chief Executive Officer, APAC

Bolttech

Philip Weiner

Chief Executive Officer, APAC

Philip Weiner oversees the commercial operations of bolttech’s businesses across APAC. As part of his remit, Philip is responsible for developing and implementing bolttech’s growth strategies and ensuring financial and business objectives are met across these regions. He was previously Group Chief Data Officer, leading the data insights function at bolttech. Prior to joining bolttech, Philip worked in insurance and consulting across various functions including product, finance, and risk management.

-

Pieter Franken

Guest Professor and Senior Researcher, Keio University & Co-founder

Safecast

Pieter Franken

Guest Professor and Senior Researcher, Keio University & Co-founder

Pieter Franken is a passionate global Fintech Pioneer and a Deep Tech Innovator with many industry firsts under his belt. Career spanning well over 30+ years in the Financial Industry, specializing in technology leadership, FinTech, Financial Inclusion, GreenTech, AI, Cyber Security, digital innovation and large-scale digital transformations. C-level and executive positions with industry leaders such as Citigroup, Shinsei Bank, Aplus, Monex Group, Union Digital Bank and ModuleQ, and senior advisory/board positions including Elevandi (SFF), RegGenome Ltd., EmeradaCo and SAFECAST.ORG, a global NPO critically acclaimed for citizen sourced, open environmental data. Pieter is a member of Monetary Authority of Singapore (MAS) International Technology Advisory Panel (ITAP) and a Founding Member of the ASEAN Innovation Network (AFIN, now Synfindo), a nonprofit company founded by MAS (Monetary Authority of Singapore), IFC/World Bank and ABA (ASEAN Banking Association) to accelerate digital transformation across Asia and other developing regions to foster Financial Inclusion and bridging the gaps between FinTechs and Financial Institutions and operator of the APIX Platform. In 2023, Pieter co-founded the Japan Fintech Festival in collaboration with Japan Financial Supervisory Agency and Bank of Japan. Pieter holds a MSc in Computer Science from Delft University and currently is a Guest Professor and Senior Researcher at Keio University, an Adjunct Fellow with Griffith University Asia Institute (GAI) and MIT Media Lab alumni. He contributes to research in FinTech in Asia, Financial Inclusion, Citizen Science, IoT and Digital Assets.

-

Prajit Nanu

Founder & Chief Executive Officer

Nium

Prajit Nanu

Founder & Chief Executive Officer

Prajit Nanu is CEO and Founder at Nium, the global leader in real-time payments. Nium provides payments and card issuance services that redefine how businesses around the world pay and get paid. As CEO, he leads the company’s corporate and product strategy as Nium moves toward a vision of frictionless global commerce.

Based in the company’s co-headquarters in San Francisco, Prajit is currently focused on expanding the breadth, depth, speed, and reach of the Nium platform. Today, Nium’s payout network supports 100 currencies and spans 190+ countries, 100 of which are in real-time. Funds can be disbursed to accounts, wallets, and cards and collected locally in 40 markets. Nium's growing card issuance business is already available in 34 countries. Nium holds regulatory licenses and authorizations in more than 40 countries, enabling seamless onboarding, rapid integration, and compliance – independent of geography. Prajit was responsible for setting up Nium operations in Australia, Hong Kong, Singapore, India, Indonesia, Japan, Malaysia, the United Kingdom, and the United States.

Prior to co-founding Nium, Prajit held leadership positions in various global organizations. He was the Global Sales Director at TMF Group, a multinational professional services firm headquartered in Amsterdam, and was the Vice President of Sales and Account Management at WNS Global Services, a business process management company. Prajit holds a Bachelor’s in Commerce & Economics from the University of Mumbai. -

Prof. Bob Wardrop

Professor, University of Cambridge & Spin-out Founder

Cambridge University & RegGenome

Prof. Bob Wardrop

Professor, University of Cambridge & Spin-out Founder

Bob is a member of the finance faculty at the Cambridge Judge Business School where co-founded the Cambridge Centre for Alternative Finance (CCAF) and the Regulatory Genome Project. Bob’s research studies innovation at the intersection of technological change and the global financial system, and in 2021 he received the CJBS Research Impact Award for his work applying AI to regulatory information in the field of computational regulation. This research project led to the creation of a university spin-out company (RegGenome) which is recognised as being globally best-in-class in machine-based regulatory document analysis. RegGenome's data and regulatory policy data analysis solutions are currently used by more than 100 regulatory authorities and commercial enterprise customers. Bob currently serves as RegGenome's Executive Chairman and has held several advisory board roles with regulatory authorities and corporate Directorships over the course of his professional career. He continues to teach several courses at Cambridge including an MBA course called "Geopolitics & Financial Regulation". Bob holds an MBA from the Booth School of Business at the University of Chicago, an MSc from the London School of Economics, and a PhD from the University of Cambridge.

-

Rahul Advani

Global Co-Head of Policy

Ripple

Rahul Advani

Global Co-Head of Policy

Rahul Advani is the Global Co-Head of Policy at Ripple.

Based in Singapore, Rahul oversees Ripple’s engagement and advocacy with regulators and policymakers in the APAC and EMEA regions, working with Ripple's regional policy teams to support and develop regulation that promotes responsible innovation in digital assets and blockchain technology.

Prior to joining Ripple, Rahul spent over 12 years in financial services, most recently as the Head of Public Policy, Asia Pacific at the International Swaps and Derivatives Association, Inc. Prior to that, Rahul worked with Bloomberg L.P. in their offices in Mumbai, Singapore, and Hong Kong in multiple roles across valuations, business development, and sales for both exchange-traded and OTC derivative products.

Rahul is the Chair of the Blockchain Association of Singapore Stablecoin and CBDC Subcommittee, and an Ambassador for the Global Blockchain Business Council (GBBC). He is also Co-Chair of the GBBC Digital Money & Wallets Working Group.

He holds a Master in Public Policy from the Lee Kuan Yew School of Public Policy in Singapore. -

Ravi Menon

Chairman of the Board of Directors, Global Finance & Technology Network (GFTN); Ambassador (Climate Action), Singapore & Former Managing Director, Monetary Authority of Singapore

Global Finance & Technology Network (GFTN)

Ravi Menon

Chairman of the Board of Directors, Global Finance & Technology Network (GFTN); Ambassador (Climate Action), Singapore & Former Managing Director, Monetary Authority of Singapore

Mr Ravi Menon has a portfolio of work in sustainability, innovation, and inclusion.

Mr Menon is Singapore’s first Ambassador for Climate Action and Senior Adviser to the National Climate Change Secretariat at the Prime Minister’s Office. He plays a leading role in Singapore’s efforts to foster collective action internationally and transition planning locally towards a low-carbon future. He is also Chairman of the Glasgow Financial Alliance for Net Zero (GFANZ) Asia-Pacific Advisory Board and a member of the GFANZ Principals Group.

Mr Menon is Chairman of the Global Finance & Technology Network, which harnesses technology and fosters innovation for more efficient, resilient, and inclusive financial ecosystems globally. He is also a Trustee of the National University of Singapore (NUS) and Chairman of its Innovation and Enterprise Committee.

Mr Menon is Chairman of ImpactSG, a philanthropy which aims to grow a community of purposeful givers in Singapore and Asia. He is also a Board Member of The Majurity Trust, a charity which deploys cause-based funds for social needs; and a Trustee of the Singapore Indian Development Association, a community self-help group.

Prior to his current roles, Mr Menon served for 36 years in the Singapore Public Service.

As Managing Director of the Monetary Authority of Singapore (2011-23), Mr Menon oversaw monetary and macroprudential policies, reformed the financial regulatory framework, and developed Singapore as a green finance centre and a global FinTech hub. On the international front, he served as Chairman of the Network of Central Banks and Supervisors for Greening the Financial System and Chairman of the Financial Stability Board Standing Committee on Standards Implementation.

As Permanent Secretary at the Ministry of Trade & Industry (2007-11), Mr Menon helped to steer the economy during the global financial crisis. As Deputy Secretary at the Ministry of Finance (2003-07), he oversaw fiscal policy and government reserves.

Mr Menon is a recipient of the Meritorious Service Medal from the Singapore Government, the Distinguished Alumni Award from NUS, and the Distinguished Leadership and Service Award from the Institute of International Finance in Washington.

Mr Menon holds a Master's in Public Administration from Harvard University and a Bachelor of Social Science (Honours) in Economics from NUS. -

Richard Teng

Co-Chief Executive Officer

Binance

Richard Teng

Co-Chief Executive Officer

Richard Teng is an experienced executive with over three decades of financial services and regulatory experience. As the Co-CEO of Binance, he works closely with various stakeholders including regulators, policymakers, industry players and users to further the growth of Binance in a compliant and sustainable manner. Prior to this role, Richard held various senior leadership positions within the company since joining in August 2021.

Before joining Binance, Richard was CEO of the Financial Services Regulatory Authority at Abu Dhabi Global Market (ADGM), where he showcased his capabilities as one of the world’s foremost innovative regulators. Richard’s vast experience also includes being the Chief Regulatory Officer of the Singapore Exchange (SGX) and the Director of Corporate Finance in the Monetary Authority of Singapore.

Richard received his Masters in Applied Finance from the University of Western Australia. -

Sopnendu Mohanty

Group Chief Executive Officer

Global Finance & Technology Network (GFTN)

Sopnendu Mohanty

Group Chief Executive Officer

Sopnendu Mohanty is the Co-founder and Group CEO of the Global Finance & Technology Network (GFTN), a global advisory and investment firm. At GFTN, he leads innovative strategies that drive development and transformation in the financial sector through four operating arms: Forums, Advisory, Platform, and Capital.

He served at the Monetary Authority of Singapore (MAS) as its first Chief Fintech Officer for nearly a decade, establishing Singapore on the global map as a leading center for innovation in the financial sector and a dynamic hub for fintech development. He continues to advise MAS on technology and innovation.

He currently serves on several boards, including the board of A*STAR, Singapore’s leading public sector agency dedicated to advancing scientific discovery and technological innovation. Before his leadership role in the public sector, he spent nearly two decades at Citigroup. He is credited with developing many public goods, including the notable PayNow, Singapore’s digital public infrastructure for payments. He conceptualized the globally well-known Singapore Fintech Festival and its global network of forums; today, the GFTN forum is the world’s largest convenor of tech, policymakers, and the financial sector community. Mr. Mohanty has co-authored several patented works in digital finance and received numerous industry accolades. He advises governments and various institutions on policies and implementation strategies for innovation, infrastructure, and ecosystem development in the financial sector. -

Sreeni Unnamatla

Executive Vice President Asia Pacific & Japan

Kore.ai Inc

Sreeni Unnamatla

Executive Vice President Asia Pacific & Japan

Sreeni has spent over 30 years in Asia Pacific & Japan in various executive and leadership roles with Global IT & Software firms and with an extensive understanding of Local & Global business practices. Has successfully established several cutting-edge technology businesses and expanded into the APAC markets over the last two decades.

-

Sumnesh Joshi

Deputy Director General, Ministry of Communications

Government of India

Sumnesh Joshi

Deputy Director General, Ministry of Communications

Mr Sumnesh Joshi is an officer from Indian Telecom Service Cadre and at present is posted as Deputy Director General in Ministry of Communications at DoT Mumbai. He is working in area of communication expanding 5G use cases , IoT and implementation the policies to ensure smooth roll out of telecom network by service providers. He has also been made Nodal officer for monitoring of 4G network saturation Project in East and West region of the country. He is working to make digital ecosystem partners like Fintechs , Banks state government departments to make use of Digital Public Good Infrastructure and use AIML to curb the cyber threats.

He worked with UIDAI as a first officer at UIDAI Regional Office Mumbai in April 2010 as a part of the founding team under leadership of Mr NandanNilekani. He was instrumental to roll out the implementation of biometric based Digital Identity“Aadhaar” project in Maharashtra, Gujarat, Goa, Dadra Nagar Haveli and Daman Diu. He worked with the Aadhaar Eco System Partners like State Governments, Regulators, Banks, Insurance Companies and Fintech Companies and guiding them in designing the solutions for the convenient delivery of various services using “Aadhaar”.

He facilitated the use of Aadhaar -a Digital Identity Platform in E-Governance for Targeted Delivery of Services and Benefits. He also headed Enrolment & Update vertical of UIDAI PAN India. He was in various committees to look into the Strengthening of Aadhaar Enrolment Processes, Revisiting the regulations and SoPs, Automation of various Processes and Universal Client for Enrolment & Update.

Mr Joshi is an officer of 1993 Batch of Indian Telecom Service and has over 25 years of experience at various positions in Government of India. Earlier years of his career He worked with Department of Telecommunications, Government of India and was involved in Telecom Traffic Planning , Data Analytics, Project implementation, Marketing of Services, Market Strategies, Market Intelligence, Product Development and Brand building.

Mr Joshi is an expert in DPI implementation, use of telecom , cyber security strategies , data analytics and speaking at various forums on digital identity , Fintech , data centres , AI, cyber security, ESG at international and national level. He delivered a TEDx talk on India’s digital identity.

Mr Joshi did his engineering in Electronics &Communications from Rajasthan Technical University Kota Rajasthan India. He holds MicroMasters in Data Economics and Development Policy from Massachusetts Institute of Technology, USA. He pursued a Certificate course in Public Policy from University of California Berkeley and MBA from the Management Development Institute Gurgaon, India.

2026 Theme: Connecting Financial Corridors for the Next Decade

Japan stands as one of the world’s largest, most resilient, and forward-looking economies—anchoring stability while driving innovation across the global financial landscape. With deliberate regulation, digital transformation, and coordinated policy frameworks, Japan is reshaping how capital flows, markets connect, and sustainable growth is achieved. Japan is also pioneering financial and technology-driven approaches to address the challenges and opportunities of an aging society—leveraging innovation to support longevity, economic inclusion, and intergenerational prosperity.

Explore how Japan’s proven capacity for long-term planning and technological foresight—in areas such as digital assets, AI, and quantum technology—is enabling new forms of connectivity, trust, and opportunity, building corridors for shared prosperity across Asia and the world.

- Rising Japan–Asia–Global Corridor

- Unifying Japan’s Financial Hubs

- Bridging Investors and Innovators Connection

- Digital Assets: Unlocking New Possibilities

- AI Powered Financial Systems

- Cybersecurity for Trust in Finance

- Reinventing Capital Markets for a Connected World Future

- Next-Gen Asset Management Strategies

- Digital Era Insurance: Innovating Risk & Coverage

Programme Overview

Main Stage: Expert Dialogue

Agentic AI, Tokenization, and $13 Trillion Capital Flow: Japan's Edge in the Global Market

The Expert Dialogue is the largest stage at the GFTN Forum, Japan and will feature Heads of State, policymakers, financial services leaders, founders, investors and technology experts. These experts will dive deeper into the most consequential topics impacting the financial services industry today in Japan, the APAC region and across the globe: geo-political dynamics, macro-economic movements, Artificial Intelligence (AI), digital assets, payments, sustainability and more.

Friday 27th February

Main Stage, B2F, BelleSalle

The Founders PeakTM

Founders Day

Main Stage, B2F, BelleSalle

![GFTN InsightsTM [Chatham House Roundtables]](https://gftnforum.jp/hubfs/JFF/JFF%202025/SM%20Posts/JFF%20Insights%20Forum%203-1.jpg)

GFTN InsightsTM [Chatham House Roundtables]

Engage in exclusive, high-level roundtable discussions where industry leaders, regulators, and market makers come together to craft real-world solutions. Through collaborative efforts such as whitepapers, working groups, and public commitments, we aim to shape the future of the industry.

- Purpose-Driven Dialogue Under Chatham House Rules

- Drive Tangible Outcomes

Friday 27th February

Roundtable Room 1-3, 5F/4F, BelleSalle

GFTN Global Premium Lounge

The GFTN Global Premium Lounge is an exclusive, invitation-only space for senior leaders, investors, and distinguished guests to connect in a refined setting. Featuring curated networking, private meeting areas, and premium hospitality, it offers a quiet retreat for high-level conversations and strategic connections.

Thursday 26th February

GFTN Premium Lounge, B2F, Bellesalle

Fintech Expo

Exhibition Showcase & 1-1 Meetings

*****

Investor Hours: Where investors and startups from across the world convene for fundraising, investment, collaboration, and market expansion opportunities.

Bellesalle Tokyo-Nihonbashi, Tokyo

Investor Hours

Where investors and startups from across the world convene for fundraising, investment, collaboration, and market expansion opportunities.

Friday 27th February

.jpg)

GFTN VIP Reception

Nihonbashi, Tokyo

Tokyo Rooftop Night

This event will be organized by FINOLAB, Japan Fintech Association and GFTN.

(**To access the venue, guests will need to present GFTN Forum pass.)

The Founders ROCKTM

Cotton Club, TOKIA 2F, TOKYO Bldg., 2-7-3 Marunouchi, Chiyoda-ku, Tokyo

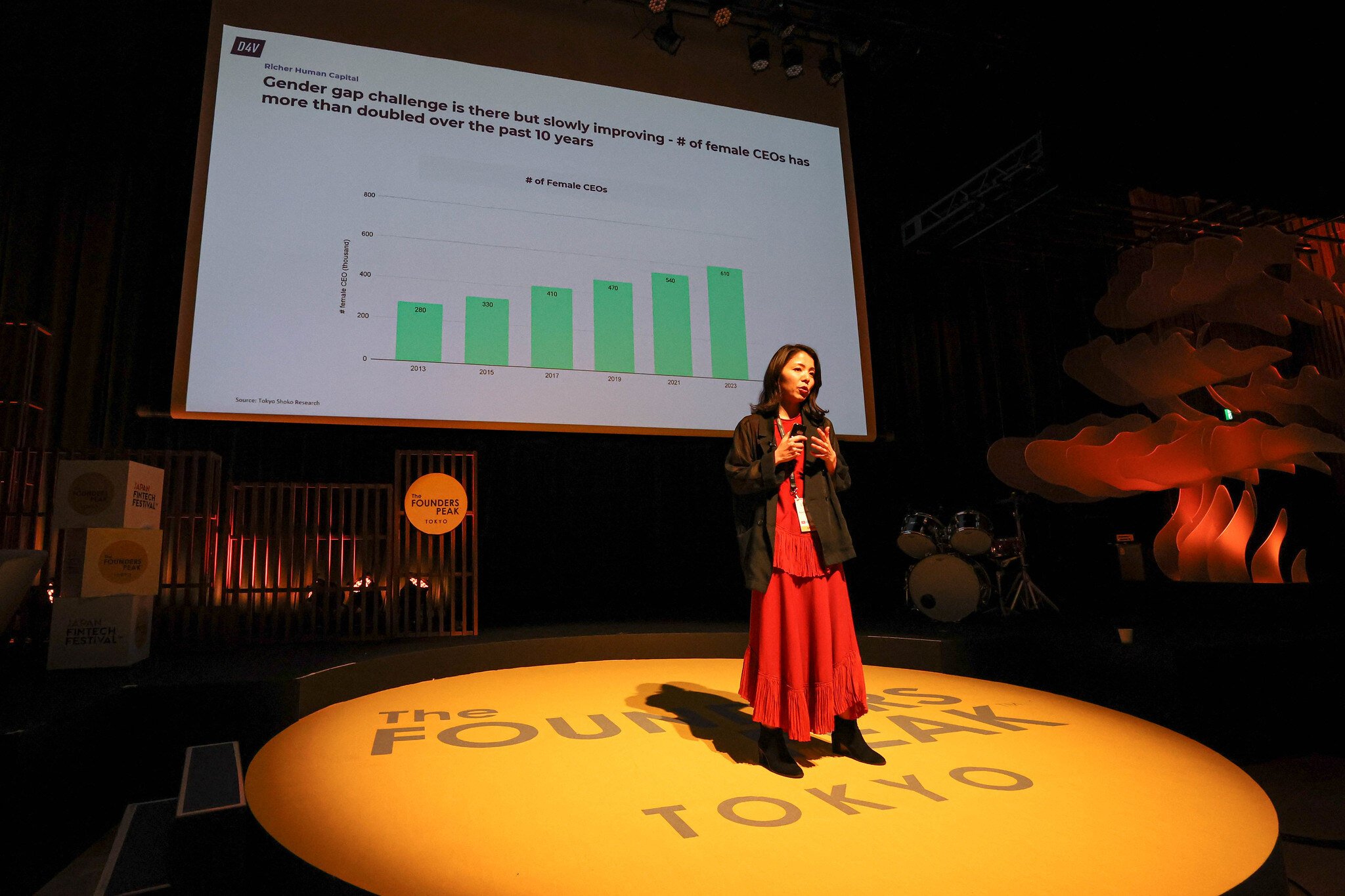

The Founders Peak

The Founders PeakTM

Festival Stage, 2F, EDOCCO, Kanda Myojin

Welcoming Our 2026 Sponsors

Grand

.png)

Platinum

Gold

Silver

Friends of Fintech

Exhibitors

.png)

Thank You To Our 2026 Sponsors

Platinum

Friends of Fintech

Exhibitors

Forum Overview

* Live Bilingual Translation

Bellesalle Tokyo Nihonbashi

Japan Fintech Week

Opening Ceremony

Main Stage: Expert Dialogue

Agentic AI, Tokenization, and $13 Trillion Capital Flow: Japan's Edge in the Global Market

The Expert Dialogue is the largest stage at the GFTN Forum, Japan and will feature Heads of State, policymakers, financial services leaders, founders, investors and technology experts. These experts will dive deeper into the most consequential topics impacting the financial services industry today in Japan, the APAC region and across the globe: geo-political dynamics, macro-economic movements, Artificial Intelligence (AI), digital assets, payments, sustainability and more.

Main Stage, B2F, BelleSalle

The Founders PeakTM

Main Stage, B2F, BelleSalle

![GFTN InsightsTM [Chatham House Roundtables]](https://gftnforum.jp/hubfs/JFF/JFF%202025/SM%20Posts/JFF%20Insights%20Forum%203-1.jpg)

GFTN InsightsTM [Chatham House Roundtables]

Engage in exclusive, high-level roundtable discussions where industry leaders, regulators, and market makers come together to craft real-world solutions. Through collaborative efforts such as whitepapers, working groups, and public commitments, we aim to shape the future of the industry.

- Purpose-Driven Dialogue Under Chatham House Rules

- Drive Tangible Outcomes

Roundtable Room 1-3, 5F/4F, BelleSalle

Expert Workshops

Engage in exclusive, high-level roundtable discussions where industry leaders, regulators, and market makers come together to craft real-world solutions. Through collaborative efforts such as whitepapers, working groups, and public commitments, we aim to shape the future of the industry.

- Purpose-Driven Dialogue Under Chatham House Rules

- Drive Tangible Outcomes

Workshop Room 2, 5F, BelleSalle

.png)

GFTN Global Premium Lounge

The GFTN Global Premium Lounge is an exclusive, invitation-only space for senior leaders, investors, and distinguished guests to connect in a refined setting. Featuring curated networking, private meeting areas, and premium hospitality, it offers a quiet retreat for high-level conversations and strategic connections.

GFTN Premium Lounge, B2F, Bellesalle

Fintech Expo

*****

Investor Hours: Where investors and startups from across the world convene for fundraising, investment, collaboration, and market expansion opportunities.

Bellesalle Tokyo-Nihonbashi, Tokyo

Innovation Tours

Workshops / 1-1 Meetings / Speaker Lounge / VIP & Exec Lounge/ Official Side Events

Investor Hours

Where investors and startups from across the world convene for fundraising, investment, collaboration, and market expansion opportunities.

.jpg)

GFTN VIP Reception

Nihonbashi, Tokyo

Tokyo Rooftop Night

This event will be organized by FINOLAB, Japan Fintech Association and GFTN.

(**To access the venue, guests will need to present GFTN Forum pass.)

Izakaya Night

Restaurants around Kayabacho Area

The Founders ROCKTM

Cotton Club, TOKIA 2F, TOKYO Bldg., 2-7-3 Marunouchi, Chiyoda-ku, Tokyo

International Delegations, Embassy Receptions and Community Partner Events

The Founders Peak

Festival Stage, 2F, EDOCCO, Kanda Myojin

FinoPitch Awards

JFSA Blockchain Roundtable

The GFTN Forum, Japan 2025, is part of the Japan Financial Services Agency's Japan FinTech Week (JFW). This Forum highlights the dynamic international ecosystem within JFW, embracing the bold theme of "Building Financial Corridors Worldwide" while supporting the domestic ecosystem.

The Forum will focus on:

- Building Financial Corridors: Connecting South and North Asia, ASEAN, and the rest of the world through innovative solutions and capital.

- Exploring the Impact of Technology: Investigating how AI, Quantum Technology, and Digital Assets transform economies, focusing on practical implementation.

- A Deep-Dive Inquiry: Examining the future of technology transformation in three key areas: Asset Management, Digital Assets, and Future Tech Stack.

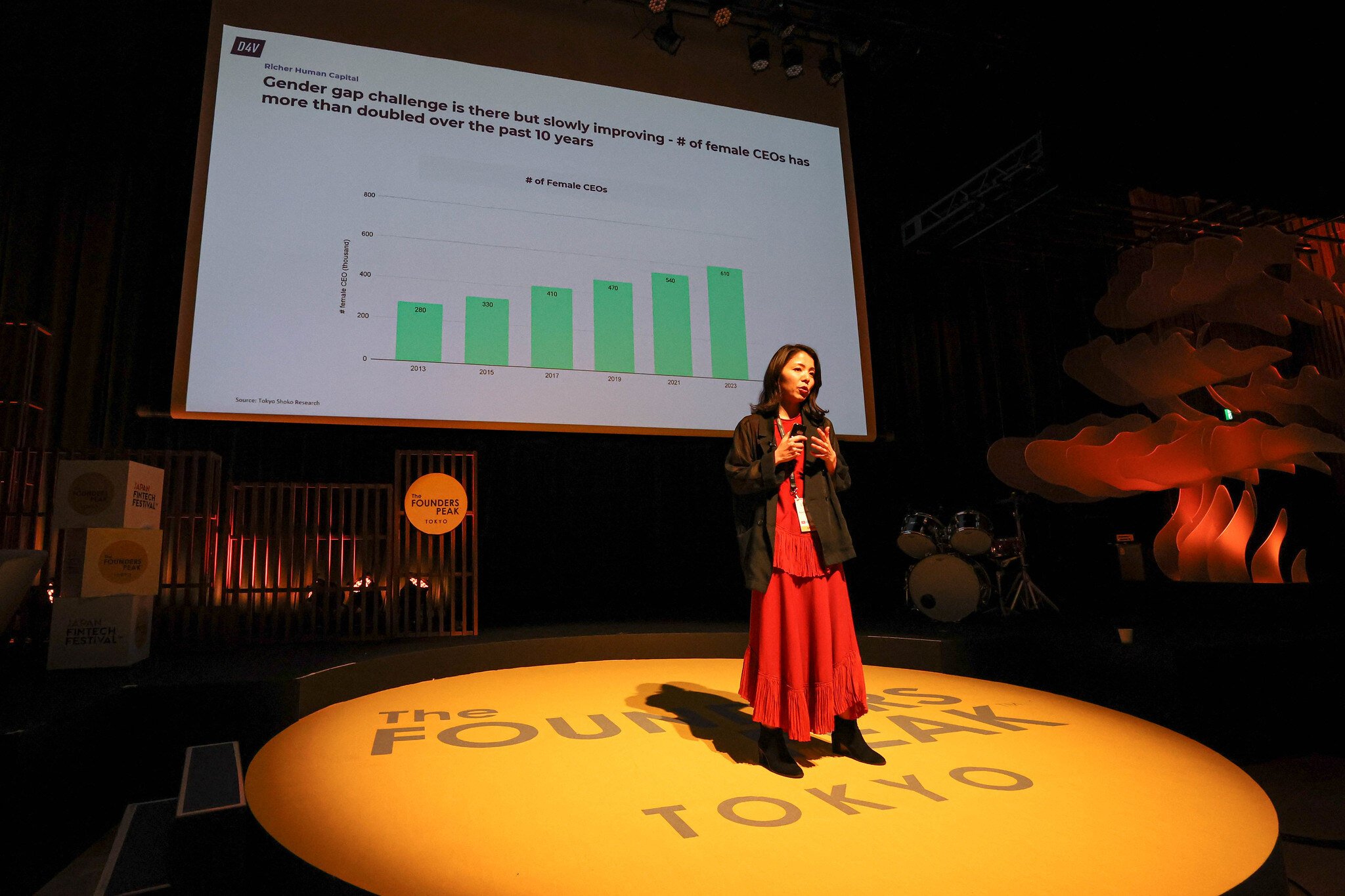

- Expanding the Founder's Peak™ Program: We are enhancing the highly successful Founder's Peak™ program with a new partner segment called "We The Women" (WTW), dedicated to celebrating women impact makers.

- Driving Actionable Results: Collaborating on reports and initiatives that engage the public and private sectors to achieve meaningful outcomes.

Barkha Dutt

Television Journalist & Author

MoJo Story

Barkha Dutt

Television Journalist & Author

Since its inception at the close of 2019, Mojo Story has been twice recognized as India's Best Digital Channel by the News Broadcasting Awards. Barkha Dutt is also the curator of We The Women, India's Biggest Women's Festival.

Barkha Dutt

Television Journalist & Author

MoJo Story

Since its inception at the close of 2019, Mojo Story has been twice recognized as India's Best Digital Channel by the News Broadcasting Awards. Barkha Dutt is also the curator of We The Women, India's Biggest Women's Festival.

Clay Chandler

Executive Editor, Asia

Fortune

Clay Chandler

Executive Editor, Asia

Clay Chandler

Executive Editor, Asia

Fortune

Doug Feagin

President

Ant International

Doug Feagin

President

He joined Ant Group in June 2016 to spearhead the company's globalization strategy, Alipay's global business development, operations and marketing activities. Prior to joining Ant Group, Mr. Feagin worked at Goldman Sachs from August 1994 to May 2016 and served as a Managing Director from 2004 through 2016.

At Goldman Sachs he maintained a broad set of client relationships across sectors including banks, specialty finance, FinTech and insurance in the U.S., Latin America and Asia.

He graduated from the University of Virginia with a Bachelor's Degree in Economics in June 1988, and he received an MBA from Harvard Business School in June 1994.

Doug Feagin

President

Ant International

He joined Ant Group in June 2016 to spearhead the company's globalization strategy, Alipay's global business development, operations and marketing activities. Prior to joining Ant Group, Mr. Feagin worked at Goldman Sachs from August 1994 to May 2016 and served as a Managing Director from 2004 through 2016.

At Goldman Sachs he maintained a broad set of client relationships across sectors including banks, specialty finance, FinTech and insurance in the U.S., Latin America and Asia.

He graduated from the University of Virginia with a Bachelor's Degree in Economics in June 1988, and he received an MBA from Harvard Business School in June 1994.

Jun Murai

Professor & Special Advisor

Keio University

Jun Murai

Professor & Special Advisor

He is a Special Advisor to the Japanese Cabinet and an Advisor to the Digital Agency serves on many other governmental committees, and is active in numerous international scientific associations.

He was inducted into 2011 IEEE Internet Award / the 2013 Internet Hall of Fame (Pioneer) / 2019 the Knight of the Legion of Honor by the French Government.

Jun Murai

Professor & Special Advisor

Keio University

He is a Special Advisor to the Japanese Cabinet and an Advisor to the Digital Agency serves on many other governmental committees, and is active in numerous international scientific associations.

He was inducted into 2011 IEEE Internet Award / the 2013 Internet Hall of Fame (Pioneer) / 2019 the Knight of the Legion of Honor by the French Government.

Marco Bizzozero

Head of International & Member of the Executive Committee

iCapital

Marco Bizzozero

Head of International & Member of the Executive Committee

Marco has more than 25 years of international experience in the financial industry and has held senior executive positions in global organizations in wealth management and private equity. He joined iCapital from UniCredit, where he was CEO of Group Wealth Management and a member of the Group Executive Management Committee. Previously, Marco was with Deutsche Bank for 14 years, including nine years as Head of Wealth Management EMEA and CEO of Deutsche Bank Switzerland and, prior to this, as Global Head of Private Equity for the Wealth Management division. Before joining Deutsche Bank, Marco was Head of Private Equity Secondary Investments at LGT Capital Partners. He started his career with UBS where he held various roles in investment banking and private equity in Zurich, London, and New York.

He received a Master of Arts (lic. oec. HSG) from the University of St. Gallen, Switzerland, and has served on the boards of the Swiss Bankers Association, the Association of Foreign Banks in Switzerland, and the Swiss Finance Institute. He is currently a member of the Advisory Committee of Elevandi, an organization set up by the Monetary Authority of Singapore to foster an open dialogue between the public and private sectors to advance fintech in the digital economy.

Marco Bizzozero

Head of International & Member of the Executive Committee

iCapital

Marco has more than 25 years of international experience in the financial industry and has held senior executive positions in global organizations in wealth management and private equity. He joined iCapital from UniCredit, where he was CEO of Group Wealth Management and a member of the Group Executive Management Committee. Previously, Marco was with Deutsche Bank for 14 years, including nine years as Head of Wealth Management EMEA and CEO of Deutsche Bank Switzerland and, prior to this, as Global Head of Private Equity for the Wealth Management division. Before joining Deutsche Bank, Marco was Head of Private Equity Secondary Investments at LGT Capital Partners. He started his career with UBS where he held various roles in investment banking and private equity in Zurich, London, and New York.

He received a Master of Arts (lic. oec. HSG) from the University of St. Gallen, Switzerland, and has served on the boards of the Swiss Bankers Association, the Association of Foreign Banks in Switzerland, and the Swiss Finance Institute. He is currently a member of the Advisory Committee of Elevandi, an organization set up by the Monetary Authority of Singapore to foster an open dialogue between the public and private sectors to advance fintech in the digital economy.

Naveen Mallela

Global Co-Head of Kinexys, Managing Director

J.P. Morgan

Naveen Mallela

Global Co-Head of Kinexys, Managing Director

Naveen Mallela is the Global Co-Head of Kinexys, which is a division within J.P. Morgan focused on digital assets and digital currencies. He has been one of the founding members of Kinexys and builder of cornerstone products like Kinexys Digital Payments and Programmable Payments.

Keen enthusiast of all things digital currencies, Naveen has authored white papers on CBDCs, Shared Ledgers and Deposit Tokens and has been part of multiple industry initiatives shaping the landscape of digital money.

Prior to founding Kinexys, Naveen held several roles at J.P. Morgan including APAC Head of Digital, Payments.

Naveen is a graduate from the prestigious Indian Institute of Management (IIM) Bangalore and a CFA Charter holder.

Naveen Mallela

Global Co-Head of Kinexys, Managing Director

J.P. Morgan

Naveen Mallela is the Global Co-Head of Kinexys, which is a division within J.P. Morgan focused on digital assets and digital currencies. He has been one of the founding members of Kinexys and builder of cornerstone products like Kinexys Digital Payments and Programmable Payments.

Keen enthusiast of all things digital currencies, Naveen has authored white papers on CBDCs, Shared Ledgers and Deposit Tokens and has been part of multiple industry initiatives shaping the landscape of digital money.

Prior to founding Kinexys, Naveen held several roles at J.P. Morgan including APAC Head of Digital, Payments.

Naveen is a graduate from the prestigious Indian Institute of Management (IIM) Bangalore and a CFA Charter holder.

Prajit Nanu

Co-Founder and CEO

Nium

Prajit Nanu

Co-Founder and CEO

Prajit is Nium’s technology and market visionary, responsible for expanding the company’s geographic reach and establishing Nium as the leading global infrastructure for real-time payments. Prajit is responsible for executing the business strategy and directing the overall performance and growth of the organisation.

In his role as CEO and co-founder of Nium, Prajit is the driving force behind the company’s continued mission to innovate and push boundaries. He created a single API solution that offers one connection to the real-time payments across the globe.

Prior to co-founding Nium, Prajit held leadership positions in various global organisations. He was the Global Sales Director at TMF Group, a multinational professional services firm headquartered in Amsterdam, and was the Vice President of Sales and Account Management at WNS Global Services, a business process management company.

Prajit Nanu

Co-Founder and CEO

Nium

Prajit is Nium’s technology and market visionary, responsible for expanding the company’s geographic reach and establishing Nium as the leading global infrastructure for real-time payments. Prajit is responsible for executing the business strategy and directing the overall performance and growth of the organisation.

In his role as CEO and co-founder of Nium, Prajit is the driving force behind the company’s continued mission to innovate and push boundaries. He created a single API solution that offers one connection to the real-time payments across the globe.

Prior to co-founding Nium, Prajit held leadership positions in various global organisations. He was the Global Sales Director at TMF Group, a multinational professional services firm headquartered in Amsterdam, and was the Vice President of Sales and Account Management at WNS Global Services, a business process management company.

Richard Teng

Chief Executive Officer

Binance

Richard Teng

Chief Executive Officer

Richard Teng is an experienced executive with over three decades of financial services and regulatory experience. Richard has been the CEO of Binance since his appointment in November 2023. By working closely with various stakeholders including regulators, policymakers, industry players and users, Richard is furthering the growth of Binance in a compliant and sustainable manner. Prior to this role, Richard held various senior leadership roles within the company since joining in August 2021.

Before joining Binance, Richard was CEO of the Financial Services Regulatory Authority at Abu Dhabi Global Market (ADGM), where he showcased his capabilities as one of the world’s foremost innovative regulators. Richard’s vast experience also includes being the Chief Regulatory Officer of the Singapore Exchange (SGX) and the Director of Corporate Finance in the Monetary Authority of Singapore.

Richard received his Masters in Applied Finance from the University of Western Australia.

Richard Teng

Chief Executive Officer

Binance

Richard Teng is an experienced executive with over three decades of financial services and regulatory experience. Richard has been the CEO of Binance since his appointment in November 2023. By working closely with various stakeholders including regulators, policymakers, industry players and users, Richard is furthering the growth of Binance in a compliant and sustainable manner. Prior to this role, Richard held various senior leadership roles within the company since joining in August 2021.

Before joining Binance, Richard was CEO of the Financial Services Regulatory Authority at Abu Dhabi Global Market (ADGM), where he showcased his capabilities as one of the world’s foremost innovative regulators. Richard’s vast experience also includes being the Chief Regulatory Officer of the Singapore Exchange (SGX) and the Director of Corporate Finance in the Monetary Authority of Singapore.

Richard received his Masters in Applied Finance from the University of Western Australia.

Ryosuke Ushida

Chief Fintech Officer

Financial Services Agency of Japan

Ryosuke Ushida

Chief Fintech Officer

Ryosuke Ushida

Chief Fintech Officer

Financial Services Agency of Japan

Sharanjit Leyl

Chancellor

Bath Spa University

Sharanjit Leyl

Chancellor

Educated in North America with undergraduate degrees in Journalism and a Masters in English, Sharanjit has lived and worked in Washington DC, London, Tokyo, Vancouver and Singapore, bringing a truly global perspective to her work. She now regularly moderates high-level debates for the United Nations, the ADB and other multilateral and financial institutions while balancing a board career and advising companies and educational institutions on diversity, inclusion, environmental and media strategy. She is board certified and sits on several company boards internationally.

In May 2024, she made history as the first Singaporean Chancellor of a British University at Bath Spa University, succeeding Oscar-winning actor Jeremy Irons. She now divides her time between her homes in Singapore and Bath, UK.

Sharanjit Leyl

Chancellor

Bath Spa University

Educated in North America with undergraduate degrees in Journalism and a Masters in English, Sharanjit has lived and worked in Washington DC, London, Tokyo, Vancouver and Singapore, bringing a truly global perspective to her work. She now regularly moderates high-level debates for the United Nations, the ADB and other multilateral and financial institutions while balancing a board career and advising companies and educational institutions on diversity, inclusion, environmental and media strategy. She is board certified and sits on several company boards internationally.

In May 2024, she made history as the first Singaporean Chancellor of a British University at Bath Spa University, succeeding Oscar-winning actor Jeremy Irons. She now divides her time between her homes in Singapore and Bath, UK.

Sopnendu Mohanty

Group Chief Executive Officer - Designate, Global Finance & Technology Network (GFTN) & Chief FinTech Officer, Monetary Authority of Singapore

Global Finance & Technology Network (GFTN)

Sopnendu Mohanty

Group Chief Executive Officer - Designate, Global Finance & Technology Network (GFTN) & Chief FinTech Officer, Monetary Authority of Singapore

Mohanty extensively engages with global technology and financial services ecosystems and has championed notable collaborative public goods like API Exchange (APIX), Singapore Fintech Festival, Payment Rails, Data exchange platforms, and experimental programs like Project Ubin. In addition, Mohanty advises many international global advisory bodies on Fintech, Innovation and Inclusion. Within five years of his leadership, Singapore has become a leading global Fintech hub producing unicorns and home to many vibrant fintech companies.

He has co-authored several patented works in the application of digital technology in Finance and won many industry recognitions."

Sopnendu Mohanty

Group Chief Executive Officer - Designate, Global Finance & Technology Network (GFTN) & Chief FinTech Officer, Monetary Authority of Singapore

Global Finance & Technology Network (GFTN)

Mohanty extensively engages with global technology and financial services ecosystems and has championed notable collaborative public goods like API Exchange (APIX), Singapore Fintech Festival, Payment Rails, Data exchange platforms, and experimental programs like Project Ubin. In addition, Mohanty advises many international global advisory bodies on Fintech, Innovation and Inclusion. Within five years of his leadership, Singapore has become a leading global Fintech hub producing unicorns and home to many vibrant fintech companies.

He has co-authored several patented works in the application of digital technology in Finance and won many industry recognitions."

Sumnesh Joshi

Deputy Director General, Ministry of Communications

Government of India

Sumnesh Joshi

Deputy Director General, Ministry of Communications

He worked with UIDAI as a first officer at UIDAI Regional Office Mumbai in April 2010 as a part of the founding team under leadership of Mr NandanNilekani. He was instrumental to roll out the implementation of biometric based Digital Identity“Aadhaar” project in Maharashtra, Gujarat, Goa, Dadra Nagar Haveli and Daman Diu. He worked with the Aadhaar Eco System Partners like State Governments, Regulators, Banks, Insurance Companies and Fintech Companies and guiding them in designing the solutions for the convenient delivery of various services using “Aadhaar”.

He facilitated the use of Aadhaar -a Digital Identity Platform in E-Governance for Targeted Delivery of Services and Benefits. He also headed Enrolment & Update vertical of UIDAI PAN India. He was in various committees to look into the Strengthening of Aadhaar Enrolment Processes, Revisiting the regulations and SoPs, Automation of various Processes and Universal Client for Enrolment & Update.

Mr Joshi is an officer of 1993 Batch of Indian Telecom Service and has over 25 years of experience at various positions in Government of India. Earlier years of his career He worked with Department of Telecommunications, Government of India and was involved in Telecom Traffic Planning , Data Analytics, Project implementation, Marketing of Services, Market Strategies, Market Intelligence, Product Development and Brand building.

Mr Joshi is an expert in DPI implementation, use of telecom , cyber security strategies , data analytics and speaking at various forums on digital identity , Fintech , data centres , AI, cyber security, ESG at international and national level. He delivered a TEDx talk on India’s digital identity.

Mr Joshi did his engineering in Electronics &Communications from Rajasthan Technical University Kota Rajasthan India. He holds MicroMasters in Data Economics and Development Policy from Massachusetts Institute of Technology, USA. He pursued a Certificate course in Public Policy from University of California Berkeley and MBA from the Management Development Institute Gurgaon, India.

Sumnesh Joshi

Deputy Director General, Ministry of Communications

Government of India

He worked with UIDAI as a first officer at UIDAI Regional Office Mumbai in April 2010 as a part of the founding team under leadership of Mr NandanNilekani. He was instrumental to roll out the implementation of biometric based Digital Identity“Aadhaar” project in Maharashtra, Gujarat, Goa, Dadra Nagar Haveli and Daman Diu. He worked with the Aadhaar Eco System Partners like State Governments, Regulators, Banks, Insurance Companies and Fintech Companies and guiding them in designing the solutions for the convenient delivery of various services using “Aadhaar”.

He facilitated the use of Aadhaar -a Digital Identity Platform in E-Governance for Targeted Delivery of Services and Benefits. He also headed Enrolment & Update vertical of UIDAI PAN India. He was in various committees to look into the Strengthening of Aadhaar Enrolment Processes, Revisiting the regulations and SoPs, Automation of various Processes and Universal Client for Enrolment & Update.

Mr Joshi is an officer of 1993 Batch of Indian Telecom Service and has over 25 years of experience at various positions in Government of India. Earlier years of his career He worked with Department of Telecommunications, Government of India and was involved in Telecom Traffic Planning , Data Analytics, Project implementation, Marketing of Services, Market Strategies, Market Intelligence, Product Development and Brand building.

Mr Joshi is an expert in DPI implementation, use of telecom , cyber security strategies , data analytics and speaking at various forums on digital identity , Fintech , data centres , AI, cyber security, ESG at international and national level. He delivered a TEDx talk on India’s digital identity.

Mr Joshi did his engineering in Electronics &Communications from Rajasthan Technical University Kota Rajasthan India. He holds MicroMasters in Data Economics and Development Policy from Massachusetts Institute of Technology, USA. He pursued a Certificate course in Public Policy from University of California Berkeley and MBA from the Management Development Institute Gurgaon, India.

Festival Agenda Themes 2025

RISE TOGETHER I “Building the New Financial Corridor”

- The new financial corridor: Japan’s evolving role as a financial hub in Asia and the Global stage with-in rapidly changing geo-politics

- Next gen transactions: How is the payments landscape evolving from B2C to B2B, both domestically and cross-border?

- Bridging the financial gap: The role of Japan in bringing financial inclusion for underserved communities

- Hyper scaling the Start-up ecosystem: Advancing Japan’s goal to lead in finance, deep tech, and innovation by boosting start-ups, foreign investment, and talent growth

- Blueprint for digital assets: How is regulation impacting new financial products and services, from stablecoins to tokenized real-world assets, in our daily lives?

- Sustainability in action: Japan's role in financial inclusion, climate change, circular economies, green financing, and ESG, highlighting recent developments

- Asset management & capital markets: As the world's third-largest economy, how can Japan expand its role in asset management, capital markets, and transaction flows with other financial hubs

- Roadmap for AI and quantum computing: What are the latest developments and leaders in Japan, and how can they impact the bottom line and reshape financial services?

- Rising Asia: Spotlight on fintech developments from Japan's neighbors, South Korea and Taiwan, and leaders from Southeast Asia as well Japan’s latest startups

JFF 2024 Featured Speakers

Taro Kono

Minister for Digital Transformation

Japan

Taro Kono

Minister for Digital Transformation

Taro Kono

Minister for Digital Transformation

Japan

Junichi Kanda

Parliamentary Vice-Minister of Cabinet Office

Japan

Junichi Kanda

Parliamentary Vice-Minister of Cabinet Office

.png?width=400&height=400&name=Yuriko%20Koike%20(1).png)

Yuriko Koike

Governor of Tokyo

Tokyo Metropolitan Government (virtual)

Yuriko Koike

Governor of Tokyo

Ken Hasebe

Mayor of Shibuya

Ken Hasebe

Mayor of Shibuya

.jpg?width=400&height=400&name=Isowa%20San%20(2).jpg)

Akio Isowa

Group Chief Digital Innovation Officer

SMBC Group

Akio Isowa

Group Chief Digital Innovation Officer

.jpg?width=400&height=400&name=Isowa%20San%20(2).jpg)

Akio Isowa

Group Chief Digital Innovation Officer

SMBC Group

Alan Lim

Head, FinTech Infrastructure Office

Monetary Authority of Singapore

Alan Lim

Head, FinTech Infrastructure Office

Alan is the head of the FinTech Infrastructure Office at the Monetary Authority of Singapore. He is responsible for developing Singapore’s digital financial infrastructure and establishing platforms for cross border connectivity.

Prior to this, he held various leadership roles in the private sector including managing consulting and development teams across Asia Pacific.

Alan Lim

Head, FinTech Infrastructure Office

Monetary Authority of Singapore

Alan is the head of the FinTech Infrastructure Office at the Monetary Authority of Singapore. He is responsible for developing Singapore’s digital financial infrastructure and establishing platforms for cross border connectivity.

Prior to this, he held various leadership roles in the private sector including managing consulting and development teams across Asia Pacific.

Brenda Hu

Director-General of the Department of Planning and Executive Secretary of the Fintech Center

Financial Supervisory Commission (Taiwan)

Brenda Hu

Director-General of the Department of Planning and Executive Secretary of the Fintech Center

Brenda Hu

Director-General of the Department of Planning and Executive Secretary of the Fintech Center

Financial Supervisory Commission (Taiwan)

.png?width=400&height=400&name=Carole%20House%20(1).png)

Carole House

Executive In Residence

Terranet Ventures

Carole House

Executive In Residence

.png?width=400&height=400&name=Carole%20House%20(1).png)

Carole House

Executive In Residence

Terranet Ventures

Dr Daranee Saeju

Assistant Governor

Bank of Thailand

Dr Daranee Saeju

Assistant Governor

Dr Daranee Saeju

Assistant Governor

Bank of Thailand

Dr David Hardoon

CEO

Aboitiz Data Innovation

Dr David Hardoon

CEO

Dr David Hardoon

CEO

Aboitiz Data Innovation

Devendra Kumar (DK) Sharma

President & Chief Operating Officer

Kore.ai

Devendra Kumar (DK) Sharma

President & Chief Operating Officer

As President and COO of Kore.ai, DK leads Go-to-Market functions, revenue growth, client success, strategy and cross-functional collaboration. Till recently he served as the CEO of a pioneering payments startup and a lending incubator. As ex-CIO of Citigroup International, he spearheaded large scale core modernization and digitalization initiatives. He is renowned for driving enterprise-grade software development and scaling sustainable growth.

Devendra Kumar (DK) Sharma

President & Chief Operating Officer

Kore.ai

As President and COO of Kore.ai, DK leads Go-to-Market functions, revenue growth, client success, strategy and cross-functional collaboration. Till recently he served as the CEO of a pioneering payments startup and a lending incubator. As ex-CIO of Citigroup International, he spearheaded large scale core modernization and digitalization initiatives. He is renowned for driving enterprise-grade software development and scaling sustainable growth.

Doug Feagin

President

Ant International

Doug Feagin

President

Doug Feagin

President

Ant International

Dr Felix Schneider

Head FinTech Investments

DEG

Dr Felix Schneider

Head FinTech Investments

Dr. Felix Schneider is heading the investment activities in the FinTech space for global markets at KfW DEG. He is responsible for the impact-oriented investment strategy across the themes FinTech, InsurTech and Embedded Finance and manages a diversified portfolio of direct investments and funds in Asia, Africa and LatAm. In his role, Felix frequently represents DEG as Board and LPAC Member at the portfolio companies and funds. Felix holds a PhD. from University of Cologne and a CEMS Master in International Management from HEC Paris and University of Cologne.

Dr Felix Schneider

Head FinTech Investments

DEG

Dr. Felix Schneider is heading the investment activities in the FinTech space for global markets at KfW DEG. He is responsible for the impact-oriented investment strategy across the themes FinTech, InsurTech and Embedded Finance and manages a diversified portfolio of direct investments and funds in Asia, Africa and LatAm. In his role, Felix frequently represents DEG as Board and LPAC Member at the portfolio companies and funds. Felix holds a PhD. from University of Cologne and a CEMS Master in International Management from HEC Paris and University of Cologne.

Fernando Vazquez

Chief Executive Officer

SBI Digital Asset Holdings

Fernando Vazquez

Chief Executive Officer

Jesper Koll

Global Embassador

Monex Group, Inc.

Jesper Koll

Global Embassador

Jesper Koll

Global Embassador

Monex Group, Inc.

Joichi Ito

President

Chiba Institute of Technology

Joichi Ito

President

Joichi “Joi” Ito is a venture capitalist, entrepreneur, writer, and scholar focusing on the transformation of society and technology. He served as director of the MIT Media Lab from 2011 to 2019 where he lead the establishment of the Digital Currency Initiative in 2015. He has served on numerous boards, including at The New York Times Company and Sony Corporation. He was a senior independent advisor to Japanese Financial Services Agency from 2016-2019. He is a member of The Digital Society Council of the Digital Agency of Japan.

Joichi Ito

President

Chiba Institute of Technology

Joichi “Joi” Ito is a venture capitalist, entrepreneur, writer, and scholar focusing on the transformation of society and technology. He served as director of the MIT Media Lab from 2011 to 2019 where he lead the establishment of the Digital Currency Initiative in 2015. He has served on numerous boards, including at The New York Times Company and Sony Corporation. He was a senior independent advisor to Japanese Financial Services Agency from 2016-2019. He is a member of The Digital Society Council of the Digital Agency of Japan.

Joyce Phillips

Founder & Chief Executive Officer

EqualFuture Corp

Joyce Phillips

Founder & Chief Executive Officer

Joyce Phillips is an accomplished CEO and transformative leader. Ms. Phillips is Founder & CEO of EqualFuture Corp., a FinTech startup based in San Francisco, building an Ai enabled analytics based financial technology Super Ap platform that delivers affordable personal financial wellness and education to individuals and businesses.

Ms. Phillips previously held senior executive roles for Citigroup including CEO of International Retail Banking, Country Manager for Citibank Japan, and CEO of DinersClub and Citi Cards Japan.

Prior executive roles include Group Managing Director M&A, Group Chief Marketing and Innovation Officer, of Australia and New Zealand Banking Group (ANZ) and CEO of the Global Wealth Division.

Prior to joining ANZ, Ms.Phillips was President and Chief Operating Officer at American Life Insurance Company (ALICO), then a subsidiary of AIG.

Ms. Phillips serves as director on several boards including the Smithsonian National Board, and First Interstate Bank Holdings (NASDAQ FIBK) where she Chairs the Technology, Innovation and Operations Committee.

Ms. Phillips was included in the U.S. Banker "25 Most Powerful Women in Banking and Finance" list multiple years and named one of the Top 100 Fintech leaders in Asia. Ms. Phillips’ innovation in marketing has also been recognized at the prestigious Cannes Lion marketing festival.

Joyce Phillips

Founder & Chief Executive Officer

EqualFuture Corp

Joyce Phillips is an accomplished CEO and transformative leader. Ms. Phillips is Founder & CEO of EqualFuture Corp., a FinTech startup based in San Francisco, building an Ai enabled analytics based financial technology Super Ap platform that delivers affordable personal financial wellness and education to individuals and businesses.

Ms. Phillips previously held senior executive roles for Citigroup including CEO of International Retail Banking, Country Manager for Citibank Japan, and CEO of DinersClub and Citi Cards Japan.

Prior executive roles include Group Managing Director M&A, Group Chief Marketing and Innovation Officer, of Australia and New Zealand Banking Group (ANZ) and CEO of the Global Wealth Division.

Prior to joining ANZ, Ms.Phillips was President and Chief Operating Officer at American Life Insurance Company (ALICO), then a subsidiary of AIG.

Ms. Phillips serves as director on several boards including the Smithsonian National Board, and First Interstate Bank Holdings (NASDAQ FIBK) where she Chairs the Technology, Innovation and Operations Committee.

Ms. Phillips was included in the U.S. Banker "25 Most Powerful Women in Banking and Finance" list multiple years and named one of the Top 100 Fintech leaders in Asia. Ms. Phillips’ innovation in marketing has also been recognized at the prestigious Cannes Lion marketing festival.

Kathy Matsui

General Partner

MPower Partners Fund L.P.

Kathy Matsui

General Partner

Kathy is the former Vice Chair of Goldman Sachs Japan and Chief Japan Equity Strategist. Her groundbreaking ʻWomenomicsʼ research spurred the Japanese government to promote gender diversity, and she has advised corporations on governance and diversity best practices. She has an MA from Johns Hopkins School of Advanced International Studies and an AB from Harvard.

Kathy Matsui

General Partner

MPower Partners Fund L.P.

Kathy is the former Vice Chair of Goldman Sachs Japan and Chief Japan Equity Strategist. Her groundbreaking ʻWomenomicsʼ research spurred the Japanese government to promote gender diversity, and she has advised corporations on governance and diversity best practices. She has an MA from Johns Hopkins School of Advanced International Studies and an AB from Harvard.

Koichiro Shimoyama

Managing Director

NTT Digital, Inc.

Koichiro Shimoyama

Managing Director

Koichiro works for NTT Digital Inc, a subsidiary of NTT docomo Inc, as a director for token exchange business such as Crypto Asset, NFT, Stable Coins, and is primarily responsible to establish business platforms including government licenses. Before joining NTT docomo in 2023, he managed to establish a new crypto exchange start-up licensed in Japan and also helped building a corporate governance framework for another licensed crypto exchange in Japan and Singapore. He spent most of careers in Mitsubishi UFJ financial group for more than 20 years primarily in the bank's own capital investment team and risk management.

Koichiro Shimoyama

Managing Director

NTT Digital, Inc.

Koichiro works for NTT Digital Inc, a subsidiary of NTT docomo Inc, as a director for token exchange business such as Crypto Asset, NFT, Stable Coins, and is primarily responsible to establish business platforms including government licenses. Before joining NTT docomo in 2023, he managed to establish a new crypto exchange start-up licensed in Japan and also helped building a corporate governance framework for another licensed crypto exchange in Japan and Singapore. He spent most of careers in Mitsubishi UFJ financial group for more than 20 years primarily in the bank's own capital investment team and risk management.

.png?width=400&height=400&name=Laura%20Loh%20%20(2).png)

Laura Loh

Director, Investment (Blockchain)

Temasek International

Laura Loh

Director, Investment (Blockchain)